05 Dec Contribution Margin Ratio Formula Per Unit Example Calculation

That said, most businesses operate with contribution margin ratios well below 100%. It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. In the next part, we must calculate the variable cost per unit, which we’ll determine by dividing the total number of products sold by the total variable costs incurred. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs. It is considered a managerial ratio because companies rarely report margins to the public.

How to Calculate the Contribution Margin Ratio

- Thus, you need to make sure that the contribution margin covers your fixed cost and the target income you want to achieve.

- It can also be an invaluable tool for deciding which products may have the highest profitability, particularly when those products use equivalent resources.

- Companies that sell products or services that generate higher profits with lower fixed and variable costs have very good operating leverage.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Is the Contribution Margin Ratio a good measure of profitability?

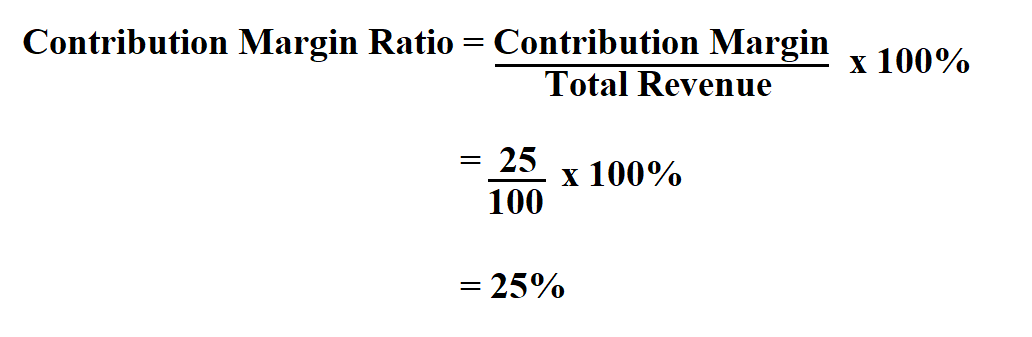

Understanding and applying this concept, helps enable businesses to make informed decisions that can enhance profitability and long-term success. Let’s say your business sold $2,000,000 in product during the first quarter of the year. The interesting thing about contribution margin ratio is that you can perform the calculation anytime to achieve a unique view into your business. Because to really understand your business, you have to control your contribution margin ratio. Now, divide the total contribution margin by the number of units sold.

Unit Contribution Margin

It offers insight into how your company’s products and sales fit into the bigger picture of your business. If the contribution margin for a particular product is low or negative, it’s a sign that the product isn’t helping your company make a profit and should be sold at a different price point or not at all. It’s also a helpful metric to track how sales affect profits over time. Profit margin is calculated using all expenses that directly go into producing the product. The contribution margin shows how much additional revenue is generated by making each additional unit of a product after the company has reached the breakeven point. In other words, it measures how much money each additional sale “contributes” to the company’s total profits.

How confident are you in your long term financial plan?

A university van will hold eight passengers, at a cost of \(\$200\) per van. If they send one to eight participants, the fixed cost for the van would be \(\$200\). If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans. We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\). If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers.

What Is the Difference Between Contribution Margin and Profit Margin?

For instance, direct material cost and direct labor cost are the costs that can be directly allocated with producing your goods. Assuming factors like demand and competition are equal, the company should make the friends and family credit union product with the highest return relative to variable costs in order to maximize profits. It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs.

The profitability of our company likely benefited from the increased contribution margin per product, as the contribution margin per dollar increased from $0.60 to $0.68. Next, the CM ratio can be calculated by dividing the amount from the prior step by the price per unit. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

The CM ratio is a useful tool for managers when making decisions such as setting sales prices, selecting product lines, and managing costs. It is also used in break-even analysis and to measure operating leverage. Labor costs make up a large percentage of your business’s variable expenses, so it’s the ideal place to start making changes. And the quickest way to make the needed changes is to use a scheduling and labor management tool like Sling. Fixed costs stay the same regardless of the number of units sold, while variable costs change per unit sold. Thus, the concept of contribution margin is used to determine the minimum price at which you should sell your goods or services to cover its costs.

When preparing to calculate contribution margin ratio, you will need to add together all of your variable expenses into one number. It is the monetary value that each hour worked on a machine contributes to paying fixed costs. You work it out by dividing your contribution margin by the number of hours worked on any given machine.

No Comments